In this issue of Member Matters:

- A message from BankVic Board Director, Tony Long

- Moving to quarterly statements for some account types

- Retirement of self-service phone banking

- BankSafe with BankVic: our top tips for online banking safety

- Updates to our Terms and Conditions

- Angela Taylor Memorial Walk/Run 2024

- Walk West 2024

- And more!

Our busy 50th year continues apace with some of the most important annual community events in our calendar taking place in April.

As sponsors of Western Health’s WalkWest event, we were thrilled to see $145,000 raised for cutting-edge equipment for the hospital. The money will go towards purchasing two extracorporeal membrane oxygenation (ECMO) machines which help keep critically ill patients alive.

As always, we were primary sponsors of the annual Angela Taylor Walk/Run, in honour of police officers who have died in the line of duty. A favourite in the BankVic calendar, this year we had a record-breaking BankVic attendance with 92 staff and family members taking part in the race at Albert Park Lake. This event allows us to remember those who have lost their lives while paying respect

to those who still work every day to ‘uphold the right’ for us all to live in a safe, secure, and orderly society. It’s truly a privilege to be part of this event.

In April and May we celebrated the best and brightest at Eastern Health and Northern Health with awards and scholarships. The awards recognise the highest achievers in nursing and midwifery and the scholarships will allow emerging leaders in the industry to undertake critical research and study.

These events demonstrate our commitment to strengthen and invest in the communities we serve. However, this commitment isn’t limited to these events. We have a responsibility to future generations to minimise our impact on the environment, which is part of the reason we’re making changes to our statement runs from July. It’s just one of the steps we’re taking to be a more sustainable and

modern business.

Finally, in May we announced that we have joined the Customer Owned Banking Association (COBA). Our admission to COBA supports our commitment to meeting the highest standards of banking service for our members and gives us access to expert advisory and support services.

These achievements make me very proud to be part of BankVic – I hope they make you proud too. You can read more about all of these in this edition of Member Matters.

Tony Long

DIRECTOR

We’re moving and changing with you

With the vast majority of members now accessing accounts and reviewing transaction history via the BankVic app and internet banking, we’re adjusting our habits with you.

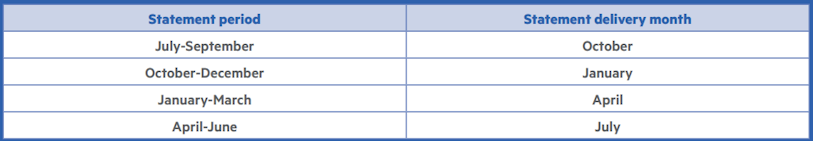

One such change is moving to quarterly statements for transaction, savings, term deposit and home loan accounts. From July, statements for these accounts will be sent quarterly, either by post or email depending on your chosen preference (see next page for details about eStatements)

Transaction, savings, term deposits and loan account statement dates:

Most of our members already use internet banking and the BankVic app to check their transactions and account balances at any time, so changing the frequency of our paper statements is us moving and changing with you.

It also means we’ll reduce our impact on the environment by minimising the printed materials we produce – as a certified B Corporation (or B Corp), we’ve made a commitment to meeting the highest standards of environmental performance.

Credit card and overdraft accounts will still receive a monthly statement.

Automated phone banking service is being retired

As usage of the BankVic app and internet banking have increased, demand for our automated self-service phone banking option has steadily decreased over time. This is reflected across banking more broadly, to the extent that the vendor has decommissioned the platform, which will take effect in November.

While we’ve investigated alternatives, the vast majority of our members already take advantage of the ease and convenience of our app and internet banking, so we’ve decided not to replace the phone banking service.

In coming months, we’ll be proactively communicating with our phone banking users to help them prepare for this change in a number of ways, including one-on-one support and guidance in setting up internet banking and/or the BankVic app, and in-person and online training sessions anyone can join to gain familiarity and comfort in the various ways to do your banking.

And as always, we’re available to help members with more complex banking needs over the phone and in our branches.

Bank online anytime with BankVic

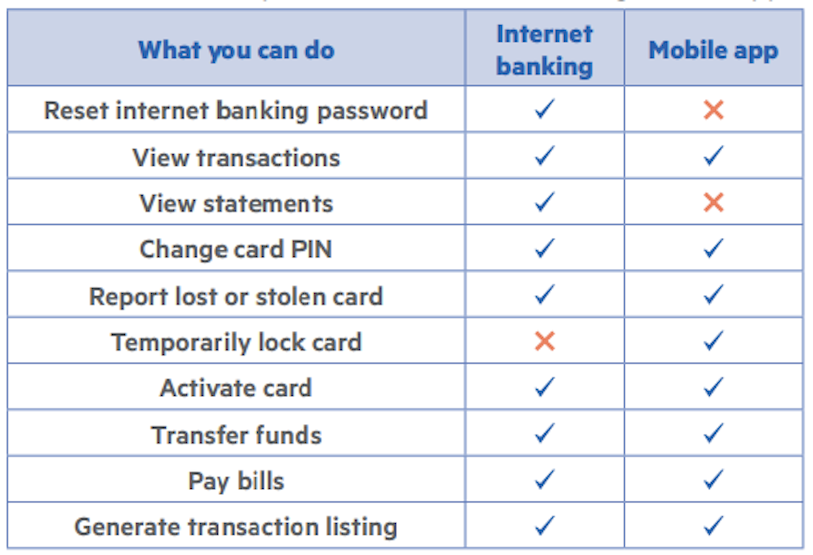

Do your banking when and where it suits you with internet banking and the BankVic app.

Whether it’s checking your account balance, reviewing transaction history, paying bills, or activating new cards, you can do it all via internet banking, and much of it through the BankVic app.

Here’s some of what you can do in internet banking and the app:

Make the switch to eStatements

Your statements can be delivered via internet banking, a more immediate, secure and sustainable way of receiving and storing all your statements.

- It’s easy and convenient. All your statements securely stored in one place – no need to sort through folders or files of paper.

- It’s fast. As soon as your eStatement is ready, we’ll email you to let you know, so there’s no need to wait for snail mail.

- It’s secure. Protect your identity and avoid lost or stolen mail. eStatements are password protected and internet banking uses encryption technology to keep your information safe.

- It’s sustainable. Less paper production and delivery means a reduced carbon footprint.

- You can change your mind. If you make the switch to eStatements and find you’d prefer to return to paper statements, you can always switch back.

Register your interest for an educational seminar on internet banking

New to online banking? Concerned about security? Or just unsure if it’s for you?

We’re seeking expressions of interest in online banking seminars at a location near you. We’ll show you how internet banking and the BankVic app could make your life easier:

- online security

- where to get help, and

- how to complete the specific things you need to do for your banking.

To register your interest: Call 13 63 73, or email info@bankvic.com.au and let us know where you’re located.

Honouring those who serve and protect: 2024 Angela Taylor Memorial Walk/Run

On 21 April, members of the police community came together to take part in the 35th annual Angela Taylor Memorial Walk/Run.

The Blue-Ribbon Foundation hold this event annually to commemorate Constable Angela Taylor, who died in the line of duty in the 1986 Russell Street Bombing. It is an opportunity to honour all the Victorian Police members who have lost their lives serving and protecting their community.

The Angela Taylor Memorial Walk/Run is one of the most anticipated dates in the BankVic calendar, and we were thrilled to have such a huge turnout with 92 participants representing BankVic.

We were so proud to see the BankVic team take out the 5km corporate team event. Especially impressive was CFO Karl Holden’s daughter, Jade, taking out the nippers 5km run in a lightning-fast 20 minutes.

As the bank for police, we are passionate about Blue Ribbon’s cause, which is why BankVic have been the event’s primary sponsor for six years. We’re proud to have had the opportunity to support our police members and our community.

Walking the walk: $145,000 raised for Western Health Foundation

Walk West is an annual fundraising event organised by the Western Health Foundation. Participants can choose to partake in a 2km, 5km, or 10km fun run (or walk) to raise money for Western Health.

On 7 April, 400 people braved the Sunday morning rain to pound the pavement in aid of the foundation’s goal to purchase life-saving technology for Western Health.

The event was a resounding success, raising $145,000 for the foundation, which will go towards purchasing two extracorporeal membrane oxygenation (ECMO) machines. This state-of-the-art equipment provides temporary support to patients with life-threatening heart and lung conditions. BankVic is a proud partner of the Western Health Foundation, and we’re thrilled to have had the opportunity to sponsor such a meaningful event.

Our nurses, our future: BankVic nursing awards

In May we celebrated our nurses and midwives with International Day of the Midwife (5 May) and International Nurses Day (12 May).

To recognise the hard work of these staff members, BankVic proudly sponsored Northern Health Foundation and Eastern Health Foundation scholarships. These scholarships endeavour to encourage members of the nursing or midwifery profession to further their education, by assisting with the associated costs.

The recipients and their respective awards and qualifications are listed below:

Northern Health Foundation

Allison Mhlanga - BankVic Nursing and Midwifery Scholarship. Allison plans on utilising the scholarship towards the completion of her post-graduate studies in anaesthetics and recover

Eastern Health Foundation

Two Eastern Health nursing and midwifery staff were awarded BankVic-sponsored scholarships on 9 May.

Samantha Merry was presented with the Chief Nursing and Midwifery Award for Nurses, for excellence in leadership and outstanding practice. The award recognises Samantha’s empathy, compassion, and dedication to the people she works with. Brindie Feil was presented with the Chief Nursing and Midwifery

Officer Award for Midwives, in recognition of her tireless support of midwives at all levels of experience, as well as her own work

Investing in the future: Eastern Health Foundation Staff Development Scholarships

The Eastern Health Staff Development Scholarship Awards Ceremony was held on 11 April. BankVic are honoured to have sponsored not only the event, but also eight of the scholarships awarded on the night.

These scholarships assist hospital staff to expand their skillset and gain valuable expertise within their field. The costs of higher education can act as a significant barrier preventing staff from pursuing further studies, so these scholarships will help talented medical professionals reach their full potential. Therefore, BankVic considers this a worthy investment in the future of our healthcare system.

Since 2019, BankVic has donated $300,000 to the Eastern Health Foundation, to support endeavours such as staff development scholarships, research and innovation, and clinical achievement.

We’re delighted to have had the opportunity to support Eastern Health and highlight our commitment to our members in the healthcare field.

2024 Angela Taylor XLI Club Memorial Scholarship

The XLI Club is a group composed of members from policing, military, business and public service backgrounds, who come together to raise funds to support Police Legacy, Blue Ribbon Foundation, Police Veterans, and other identified organisations. One of the club’s initiatives is offering youth scholarships in memory of Angela Taylor, three of which are awarded each year.

This year the XLI Club and BankVic jointly sponsored three scholarships. On 16 May, our CEO Anthony De Fazio, and CEO of Victoria Police Legacy, Lex de Man were present at the awarding of the 2024 scholarships to police legatees, Liam Quick, Anneliese Newton, and Abby Phillips.

BankVic is a supporter of the XLI Club and assists with fundraising and managing the clubs financial transactions.

For further information please contact membership@the41club.com

BankSafe with BankVic: Top Tips!

As scams and fraud continue to rise, it’s more important than ever to know how to protect yourself online. At BankVic, we take online security seriously. We’ve pulled together a list of Top Tips to help keep your personal and financial information safe - whether you’re banking online or in person.

1. Keep your personal information secure: Never share your personal information, such as

your passwords or account number, with anyone. Be cautious of unsolicited phone calls or emails asking for your personal information. Legitimate financial institutions will never ask for this information.

2. Use strong passwords: Use a unique, strong password for each account and update them regularly. A strong password has more than 8 characters (the longer, the better), is a mixture of upper and lower case characters, numbers and special characters – like exclamation marks. Avoid using actual words and personal information such as your birthdate, name, or address.

3. Beware of phishing scams: Phishing scams involve fraudulent emails or messages that appear to be from a legitimate business or organisation, asking for sensitive information. Be cautious of any unsolicited messages, and never click on links from unverified sources.

4. Monitor your accounts regularly: Keep an eye on your accounts for any unusual activity or transactions. If you see something suspicious, report it immediately to your bank.

5. Use secure Wi-Fi: Avoid conducting financial transactions over public Wi-Fi networks, which may be insecure. Use a private, secure Wi-Fi network instead.

5. 6. Stay up-to-date: Stay informed about the latest scams and frauds. Keep up-to-date with the latest security features and updates on your banking apps and software.

Account disclosure information

We’ve made some changes to our General Terms & Conditions. We recommend you review the updated General Terms & Conditions which can be found on our website: bankvic.com.au

For more information, visit bankvic.com.au